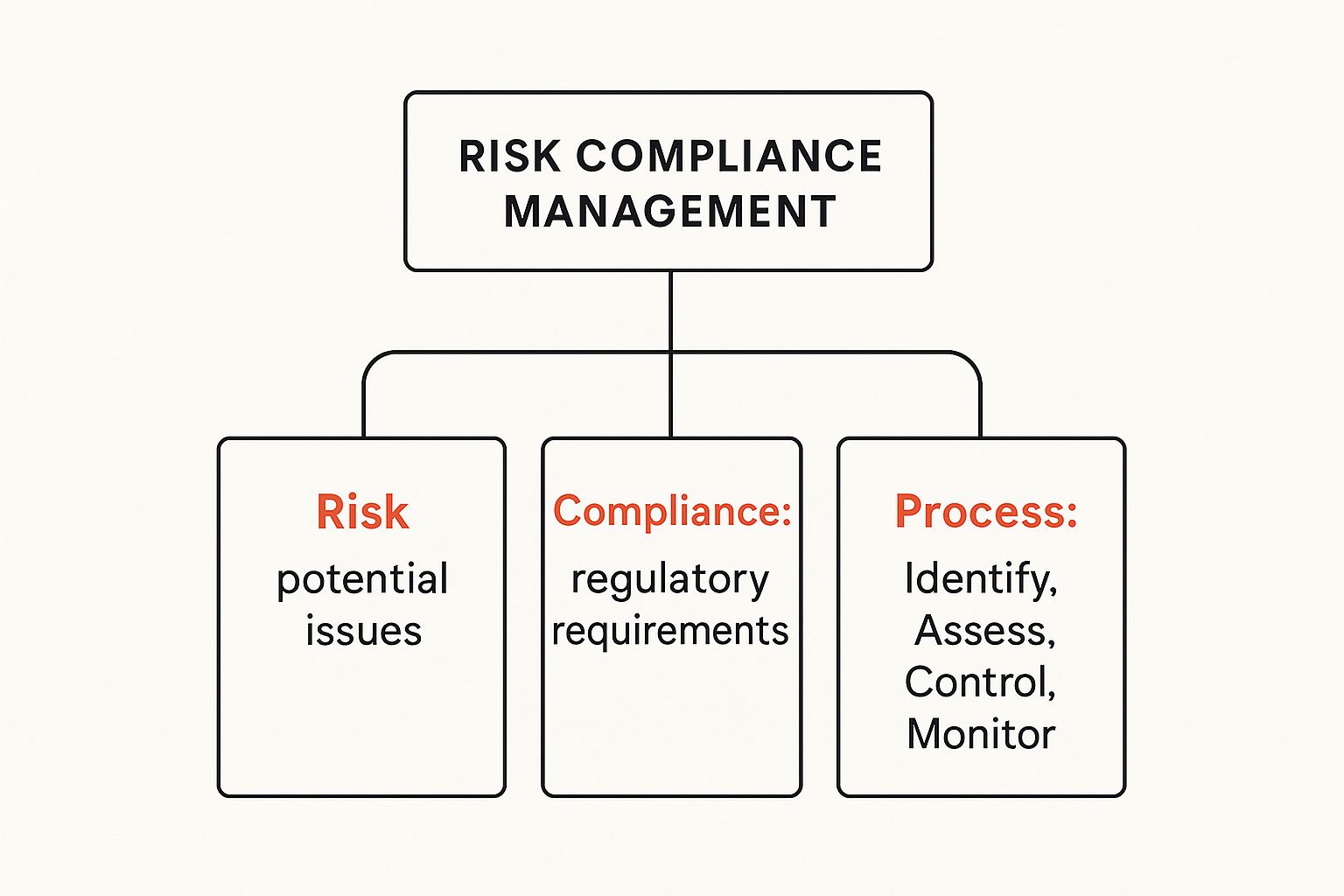

So, what is risk compliance management? It's the process of spotting potential problems (risks) and making sure your business operations are in line with all the required laws and standards (compliance). Think of it like a construction project: you’re not only trying to avoid on-site hazards but also making sure everything is built to code. When you manage both together, you build a much more stable and predictable business.

Understanding Risk Compliance Management

Risk compliance management isn't just a box-ticking exercise. It's a hands-on approach that connects what could go wrong in your business with the rules you must follow. Too often, risk and compliance are handled in separate departments, which is a recipe for gaps, duplicated work, and nasty surprises down the road.

Bringing them together creates a single, unified system. Picture a manufacturing plant. A key risk is a machine malfunctioning and injuring an operator. The compliance side of things involves strict government regulations on machine guarding and proper training. A solid risk compliance program tackles both at once, putting in place regular maintenance schedules (managing risk) that also meet official safety standards (ensuring compliance).

The Core Connection Between Risk and Compliance

When you break it down, this approach works because most regulations are actually designed to control known risks. For example, data privacy laws exist to manage the very real risk of customer information getting stolen. Environmental regulations are in place to control the risk of pollution damaging the local community.

A failure in compliance almost always creates a big business risk. Think about it: fines, legal battles, and a trashed reputation are the direct results of not playing by the rules. So, managing compliance is really just a critical part of managing your overall business risk.

This integrated view helps businesses shift from a reactive, "firefighting" mode to a proactive one. Instead of just scrambling to respond to an audit or an incident, you build a framework that anticipates and deals with potential issues before they blow up.

The Four Key Steps in the Process

Effective risk compliance management typically runs on a clear, four-step cycle. This loop helps you systematically understand your operational landscape and keep it under control. A great real-world example is putting together an infection control risk assessment to proactively identify and deal with health and safety hazards before they can cause harm.

This infographic shows how it all fits together.

As you can see, the whole system is a continuous loop of identifying, assessing, controlling, and monitoring both potential threats and your regulatory duties.

The process itself is pretty straightforward and cyclical:

- Identify: First, you need to find potential risks and make a list of all your compliance obligations. This covers everything from physical dangers on-site to complex legal statutes. A huge part of this is basic hazard identification, which you can read more about in our guide on what is hazard identification.

- Assess: Next, you analyse those risks to figure out their potential impact and how likely they are to happen. Which ones could do the most damage? Which compliance slip-ups come with the biggest penalties?

- Control: Based on that assessment, you put controls in place. These are the practical actions, policies, and procedures you use to manage the risks and stay on the right side of the rules.

- Monitor: Finally, you don’t just set and forget. You constantly track how well your controls are working and keep an eye out for new risks. This ongoing monitoring makes sure your program stays effective as your business and the rules change.

The Four Pillars of a Compliance Program

A solid risk compliance program isn’t something you can just guess at. It’s built on a practical foundation made of four distinct, interconnected pillars. When you break the process down this way, you can create a system that methodically finds, assesses, and manages your compliance obligations.

Think of it like building a house. You can't put up the walls without pouring a solid foundation first, and you definitely can't add a roof without the walls to support it. Each pillar holds up the next, creating a complete and sturdy structure for your business.

Let’s walk through what these pillars look like in practice.

The table below breaks down the four essential components of a risk compliance management framework. Each pillar builds on the last, moving from identifying potential issues to creating a living system of continuous improvement.

Four Pillars of Risk Compliance Management

| Pillar | Purpose | Example Activities |

|---|---|---|

| Risk Identification | To find and list all potential compliance issues that could affect the business. | Conducting site inspections, reviewing legislation, interviewing staff, and mapping out business processes. |

| Risk Assessment | To analyse and prioritise identified risks based on their potential impact and likelihood. | Using a risk matrix, scoring risks numerically, and deciding which issues need immediate attention. |

| Control & Mitigation | To put in place practical measures that prevent compliance breaches or reduce their impact. | Writing clear procedures, installing safety equipment, using software to protect data, providing training. |

| Monitoring & Reporting | To continuously track the effectiveness of controls and inform decision-making. | Performing regular audits, analysing incident reports, tracking key metrics, and creating management dashboards. |

This systematic approach transforms compliance from a reactive, box-ticking exercise into a proactive strategy that protects the business and its people. Now, let's look at each of these a bit more.

Pillar 1: Risk Identification

First, you need to know what you’re up against. Risk identification is the process of finding and cataloguing every potential compliance issue that could trip up your business. This isn't just about spotting physical hazards on a factory floor; it covers a massive range of operational areas.

You need to look at everything from workplace health and safety rules to data privacy laws and environmental regulations. It means actually talking to people in different departments, reviewing how things are currently done, and keeping an eye on legislative changes that could affect you.

A manufacturing firm, for instance, might identify risks like:

- Improper handling of hazardous chemicals, putting them in breach of environmental protection laws.

- Inadequate machine guarding, which fails to meet workplace safety standards.

- Incorrectly storing employee data, a clear violation of privacy regulations.

Pillar 2: Risk Assessment

Once you have a list of potential risks, you’ve got to prioritise them. That’s where risk assessment comes in. Not all risks are created equal, so you need a logical way to decide which ones demand your immediate attention and resources.

The goal here is to figure out two things for each risk you've found: its potential impact on the business and the likelihood of it actually happening. A low-impact risk that’s highly unlikely to occur can be put on the back burner. But a high-impact, high-likelihood risk needs to be dealt with, and fast.

A simple risk matrix is a great tool here. By plotting impact against likelihood, you get a clear visual map of your risk landscape. It stops being a long list of worries and becomes an actionable plan, showing you exactly where to focus your efforts.

This step has become critical. According to one report, 84% of Australian businesses now face heightened exposure to a wide range of risks, from regulatory burdens to cyber threats. The growing complexity of rules, especially in new areas like AI, has left many organisations struggling. You can read more in the BDO Global Risk Landscape Report.

Pillar 3: Control and Mitigation

After identifying and assessing your risks, it's time to do something about them. The third pillar, control and mitigation, is all about putting specific measures in place to manage your high-priority risks. These are the practical, real-world actions and policies designed to stop compliance failures from happening.

These controls can come in many forms, such as:

- Procedural Controls: This means developing and rolling out clear policies and step-by-step procedures that guide what your team does every day. A great example is creating a solid WHS policy and procedures document that everyone can actually follow.

- Technical Controls: Here, you're using technology to manage risk. Think automated shut-off systems on machinery or using software to encrypt sensitive data.

- Physical Controls: These are the tangible barriers you put in place, like installing safety railings around elevated platforms or providing personal protective equipment (PPE).

The key is making sure your controls are practical and directly linked to the specific risks you found. A vague policy that just gathers dust on a shelf is useless.

Pillar 4: Monitoring and Reporting

Finally, a risk compliance program is never a "set and forget" job. The fourth pillar, monitoring and reporting, is what makes sure the whole system stays effective over the long haul. It involves constantly tracking how your controls are performing and reporting the findings back to leadership.

Monitoring tells you if your controls are actually working as intended. This could involve regular workplace inspections, audits of your data processes, or analysing incident reports to spot any worrying trends.

Reporting is what closes the loop. It keeps management in the know about the company's risk profile and how well its compliance efforts are paying off. Clear, regular reports lead to better decision-making and make sure resources are going where they're needed most. This continuous cycle of feedback and adjustment is what keeps a compliance program alive, relevant, and effective.

Why Compliance Is a Smart Business Investment

It’s easy to look at compliance and see nothing but a cost. That’s a common mistake. A solid risk compliance management program is much more than a defensive shield against fines; it’s a strategic investment that pays real dividends. It gives you a clearer picture of your operational risks, which leads directly to smarter business decisions.

When you have a proper handle on compliance, you stop guessing what might go wrong. You gain a structured way to spot potential problems before they blow up, letting you put your resources where they matter most and protect your bottom line.

Building Trust and a Strong Reputation

In any industry, trust is key. This is especially true in sectors like manufacturing and construction. A well-run compliance program sends a clear signal to your customers, partners, and regulators that your business is reliable and operates with integrity. It shows you take your responsibilities seriously.

This kind of reputation isn't built overnight. It’s earned by consistently meeting standards, protecting data, and making sure people go home safe at the end of the day. Over time, that commitment becomes a massive competitive advantage. It opens doors to new partnerships and makes it far easier to attract and keep the best people on your team.

A proactive approach to compliance proves you're not just in it for the short term. It demonstrates a long-term commitment to quality, safety, and ethical operations, the very foundation of a resilient brand.

Uncovering Hidden Operational Efficiencies

Here’s a benefit that often flies under the radar: getting your processes standardised to meet compliance rules frequently shines a light on operational headaches. The act of documenting procedures and training your crew to follow specific standards forces you to take a hard look at how work actually gets done.

For instance, while putting new workplace health and safety rules in place, you might discover a workflow on the factory floor is clunky or puts unnecessary physical strain on your team. Fixing it doesn't just tick a compliance box; it improves productivity and cuts the risk of downtime from injuries.

It’s the same with data privacy regulations. Getting compliant often forces companies to clean up their messy data management practices. The result? Better customer insights, more effective marketing, and an end to wasting money on storing useless data. It's a classic case of a compliance requirement driving direct business improvement.

From Cost Centre to Value Driver

When you start thinking of compliance as a value driver, your whole approach changes. Instead of being a separate department that just says "no," compliance becomes part of every area of your business. When that happens, the benefits really start to stack up. This is often called 'connected compliance'.

A recent survey found that companies that nail this connected approach see huge advantages. A massive 69% reported better decision-making, and 64% pointed to a sharper awareness of risks. Interestingly, Australian firms seem to be ahead of the game here, reporting these benefits at even higher rates than their global counterparts. You can explore the full Australian insights from PwC's survey to dig into the details.

This data proves that when compliance has a seat at the main table, it stops being a box-ticking exercise. It becomes an active part of your strategy, helping you navigate challenges and grab opportunities with more confidence.

Achieving Stability and Sustainable Growth

At the end of the day, a strong risk compliance management framework is all about stability. In a world full of economic curveballs and ever-changing regulations, a business that can consistently meet its obligations is simply in a better position to survive and grow.

That stability comes from predictability. With good controls in place, you dramatically reduce the chance of expensive surprises like regulatory fines, legal battles, or major operational meltdowns. This frees you up to plan for the future, invest in growth, and build a tougher, more resilient organisation. To learn more about how to formalise these efforts, it's worth looking into achieving global compliance certification for your business.

How to Build Your Risk Compliance Program

Putting together a formal risk compliance management program can feel like a huge task. But it's far more manageable when you break it down into logical steps. It’s less about a single giant leap and more about a series of deliberate actions that build on each other.

Think of it like building a new production line. You wouldn’t just start welding things together; you’d need a detailed blueprint, the right components, and a clear assembly sequence.

This guide is that blueprint. We’ll walk you through the practical stages, from getting the initial green light to choosing the right tools that will set you up for long-term success.

Secure Leadership Support and Resources

First: you absolutely have to get support from the top. A compliance program without leadership backing is dead in the water. You need your key decision-makers to understand not just the why (avoiding fines) but also the what (the resources required to do it properly).

Pull together a straightforward business case. Spell out the specific risks the company faces, the potential financial hits and reputational damage of getting it wrong, and how a structured program is the answer. Be clear about what you need, whether it’s budget for training, dedicated staff hours, or investment in new software.

Conduct a Complete Risk Assessment

With leadership on board, your next job is to map out the terrain. A thorough risk assessment is the foundation of your entire program, so don't skip this. This is where you identify all the specific legal, regulatory, and internal policy obligations your business is meant to be meeting.

This process typically involves:

- Listing Regulations: Pinpoint all relevant legislation that applies to you, from workplace health and safety laws to environmental standards and data privacy acts.

- Mapping Processes: Get on the ground and analyse your key business operations to see where compliance risks actually live. How does your production team handle chemical waste? How does sales manage customer data?

- Prioritising Risks: Once you have a list, use a risk matrix to figure out which issues pose the greatest threat. You can't tackle everything at once, so focus on the risks with high impact and high likelihood first.

The goal of this assessment isn't to create a perfect, exhaustive list on day one. It's to build a practical, working inventory of your most significant compliance duties. This gives you a clear starting point and helps you direct your resources where they’ll make the most impact.

Develop Clear Policies and Procedures

You know what your risks are. Now you need to create the rules of the road for your team. This means developing clear, easy-to-understand policies and procedures that people can actually follow.

Ditch the legal jargon and complex language. If your team can’t understand a policy, they can’t follow it. It’s that simple.

For each major risk you identified, create a document that lays out the company’s official stance and the specific steps employees must take. A perfect example of a practical procedure is to implement a robust document retention policy, which directly addresses data management and regulatory risks.

And make these documents accessible. Don’t bury them on a server no one can find. Use a central document hub or company intranet so everyone knows exactly where to find the latest versions.

Organise Training and Communication

A great set of policies is useless if nobody knows they exist. To bring your risk compliance program to life, you need consistent training and open communication. The goal is to make sure every person understands their specific responsibilities.

Training should be tailored. The compliance training for a factory floor worker will look very different from what an HR manager needs. Keep it practical and use real-world examples that people can relate to their day-to-day work.

Choose the Right Tools for the Job

Finally, you'll need the right gear to manage everything effectively. For a very small business, a set of well-organised spreadsheets might do the trick to get started. But as your organisation grows, that approach quickly becomes a messy, error-prone nightmare.

This is where dedicated Governance, Risk, and Compliance (GRC) platforms come in. These tools centralise everything, from your risk registers and policy documents to incident reporting and audit trails. The Australian GRC platform market is exploding for this very reason, expected to jump from USD 1.4 billion in 2024 to USD 3.7 billion by 2033. This growth is being pushed by tougher regulatory demands that require better oversight.

The right software gives you a single source of truth, making it much easier to see what’s going on and prove compliance when the auditors come knocking.

To help you get started, here is a simple checklist to guide you through the process.

Implementation Checklist for Your Compliance Program

| Phase | Key Action | Success Indicator |

|---|---|---|

| 1. Foundation | Secure executive sponsorship and budget allocation. | Approved business case and dedicated resources. |

| 2. Discovery | Conduct a comprehensive risk assessment. | A prioritised risk register is created and reviewed. |

| 3. Documentation | Develop and approve core policies and procedures. | Key policies are published and accessible to all staff. |

| 4. Rollout | Launch initial training programs for all employees. | Training completion rates exceed 90%. |

| 5. Technology | Select and put a GRC software or system in place. | The chosen tool is configured and operational. |

| 6. Monitoring | Establish a schedule for regular audits and reviews. | The first internal audit is completed within 6 months. |

This checklist provides a high-level roadmap, but remember that building a compliance program is an ongoing journey, not a one-off project. It requires continuous effort and adjustment to stay effective.

Common Compliance Mistakes to Avoid

Even the best plans can fail if you fall into a few common traps. Building a solid risk compliance management program isn't just about ticking boxes on a checklist; it's about knowing what not to do. The good news is, you can learn from the missteps others have made to build a system that actually works from day one.

Time and again, we see organisations making the same errors, from treating compliance like a one-time project to writing policies no one can actually understand. Avoiding these pitfalls is the difference between a program that protects your business and one that just creates more admin headaches.

Treating Compliance as a One-Off Project

One of the biggest blunders is viewing compliance as a task with a neat start and finish. A company might scramble to get everything in order for an audit, breathe a sigh of relief when they pass, and then promptly forget about it until the next audit comes up.

This approach just doesn't work. Regulations are constantly changing, new risks emerge, and your own business operations evolve. A policy that was perfectly fine last year could be dangerously out of date today.

Effective risk compliance management isn't a project; it's a living process. Think of it like maintaining the equipment on a factory floor. You don’t just service a machine once and assume it’s good forever. You run regular checks and perform preventative maintenance to keep it running safely and efficiently.

How to fix it:

Set a schedule to review your entire compliance program. This should happen at least once a year, or whenever there’s a major change like new legislation being passed or new machinery being installed. This shifts compliance from a reactive panic into a proactive, continuous cycle.

Writing Overly Complicated Policies

Another classic mistake is drafting policies so dense with legal jargon and corporate fluff that they’re almost impossible to use. If your frontline workers need a law degree to figure out what a safety procedure means, that procedure won't be followed.

Policies need to be clear, concise, and written for the people who actually have to apply them. The goal is straightforward guidance, not a document that will impress a team of lawyers.

How to fix it:

Write everything in plain, simple language. Before you finalise any new policy, get a few frontline employees to read it. If they look confused or have questions, it’s back to the drawing board. Use visual aids like flowcharts, diagrams, and checklists wherever you can to make the information stick.

Working in Departmental Silos

Compliance isn't just the safety manager's job, nor is it solely the responsibility of the legal department. When different parts of the business manage their own compliance duties without talking to each other, you end up with massive gaps and a lot of wasted effort.

For instance, the HR team might be managing employee data one way to meet privacy laws, while the IT department has a totally different system that isn't aligned. This disconnect creates unnecessary risk and makes it impossible to get a clear, company-wide view of your risk profile.

How to fix it:

Create a cross-departmental compliance committee. This team should have people from key areas like operations, HR, IT, and finance. Get them in a room regularly to discuss risks, coordinate their efforts, and share information. This breaks down the silos and makes sure everyone is working from the same playbook, creating a truly unified approach to risk compliance management.

Frequently Asked Questions

Jumping into risk compliance management can feel overwhelming, and it usually brings up a bunch of questions. Here are some straight, practical answers to the questions we hear most often from managers and business owners.

How Do We Start Risk Compliance Management With a Small Budget?

Having limited funds doesn't mean you have to put compliance on the back burner. The trick is to be smart and focus on the actions that give you the most bang for your buck. Forget about fancy, expensive software for now; you can build a solid foundation with basic tools and some clever prioritisation.

Kick things off with a simple risk assessment using a spreadsheet. List your most pressing legal and regulatory duties, things like workplace health and safety rules or environmental standards you absolutely must meet. Then, go talk to your team on the frontline. They know exactly where the real-world risks are hiding.

From there, nail the basics:

- Prioritise ruthlessly. Use a simple high/medium/low rating for both the impact and likelihood of a risk. Go after the "high-high" risks first, as these are the ones that pose the biggest threat to your business.

- Keep procedures simple. Instead of writing a massive policy manual nobody will read, create clear, one-page checklists for your most critical tasks.

- Use free resources. Government bodies like Safe Work Australia offer a lot of free guidance, templates, and checklists. Tap into them.

The goal isn't perfection from day one; it's about making a real start. By tackling your biggest vulnerabilities first, you can make a huge difference to your risk profile without a big upfront investment.

What Is the Difference Between Risk Management and Compliance Management?

This is a common point of confusion, but the difference is important. Think of it like driving a car.

Risk management is about looking ahead and anticipating potential hazards, like spotting a sharp turn, noticing a slippery patch on the road, or keeping an eye on other drivers. It's proactive and covers anything that could stop you from reaching your destination safely.

Compliance management, on the other hand, is about following the specific rules of the road. It means obeying the speed limit, stopping at red lights, and making sure your car has a valid registration. It’s about sticking to the laws and regulations set by an external authority.

The two are joined at the hip. Breaking a traffic law (a compliance failure) dramatically increases your risk of having an accident (a risk event). A good driver does both: they follow the rules and they watch out for unexpected dangers.

In business terms, risk management is the bigger picture, looking at everything from strategic threats to financial and operational hiccups. Compliance management is a crucial part of that, focusing squarely on meeting your legal and regulatory obligations. Real risk compliance management brings them together into one strategy.

How Often Should We Review Our Compliance Program?

There’s no single magic number here, but "set and forget" is definitely not the answer. A good rule of thumb is to do a full, formal review of your entire compliance program at least once a year.

But that annual check-up is just the bare minimum. You need to be ready to react faster when things change. Certain events should trigger an immediate review of specific parts of your program.

These triggers include things like:

- A new law or regulation is introduced. When the goalposts move, your policies have to move with them.

- You have a significant incident or a near-miss. This is a massive red flag that one of your controls might have failed and needs a serious look.

- You bring in a new process or piece of equipment. New gear or workflows almost always introduce new risks that need to be managed.

- Your business structure changes. Things like rapid growth or expanding into new markets will change your compliance obligations.

Combining regular, scheduled reviews with these event-triggered checks keeps your program relevant and effective. It stops being a static document gathering dust on a shelf and becomes a living part of how you run your business.

Ready to stop juggling spreadsheets and paper forms? Safety Space offers an all-in-one platform to manage your entire health and safety system. Get real-time monitoring, simplify subcontractor oversight, and spot problems before they escalate. Book a free demo and H&S consultation at https://safetyspace.co to see how you can build a safer, more compliant workplace.

Ready to Transform Your Safety Management?

Discover how Safety Space can help you build a safer, more compliant workplace with our comprehensive safety management platform.

Book a Free DemoRelated Topics

Safety Space Features

Explore all the AI-powered features that make Safety Space the complete workplace safety solution.

Articles & Resources

Explore our complete collection of workplace safety articles, tools, and resources.